Insights

American Cannabis: A Potential $90+ Billion Market

Jonathan Cooper says, if cannabis is legalized nationally, the market would be enormous.

Summary

• Colorado and Washington imply ~$270 and $209 per person per year revenues from cannabis in a mature market.

• If cannabis is legalized nationally, the market would be enormous.

• I estimate the market size to be ~$90.5 billion in 2028 if mature.

• Colorado's experience shows that maturation might take ~4 years for growth to level off once stores are open.

MJ Data by YCharts

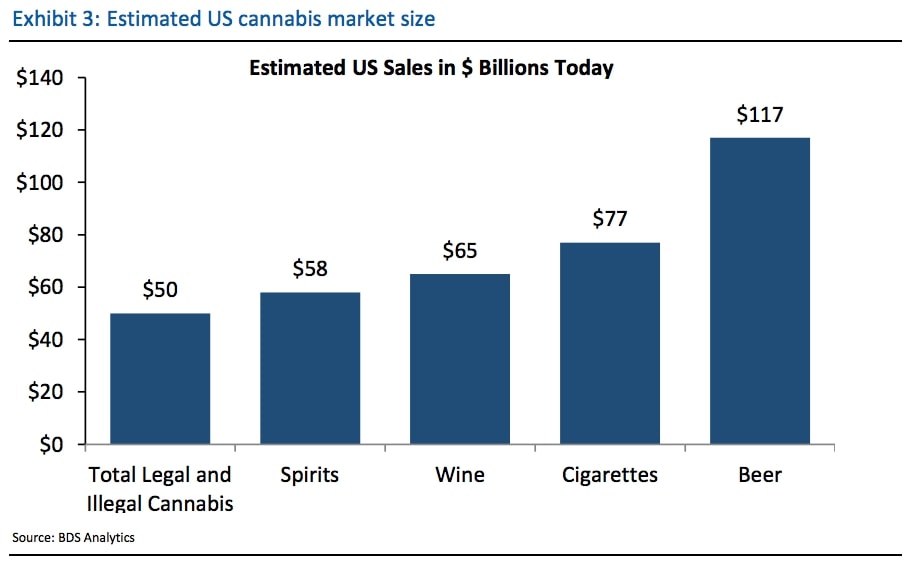

According to a note from RBC Capital Markets, American cannabis sales are quickly catching up to those of beer and wine, and the market could be worth $47 billion within a decade:

In this article, I will look at how large the cannabis market might be based on data from states where recreational cannabis is legal, especially Colorado and Washington. This data may be useful for inferring the size of a "mature" legal cannabis market in the United States.

I anticipate that recreational cannabis will be legal in a decade, given that more than half of Americans favor legalization. Thus, it may be appropriate to look at the potential size of the American market when measuring cannabis investments, be it in a personal portfolio, or be it a corporate investment like that of Constellation (STZ) into Canopy Growth (CGC).

Based on my estimate below, I estimate a $90 billion market size in 2028, if legalized soon enough for that market to be "mature" - say if legalized by ~2023. That enormous market is why companies like Constellation are willing to put $4 billion into Canopy Growth when the latter just reported C$78 million in annual revenue.

The market is potentially enormous, although who knows who might emerge with the lion's share of it. That's one good reason to hedge your bets with an ETF like the ETFMG Alternative Harvest (MJ) or Horizons Marijuana Life Sciences ETF (TSE: HMMJ) (OTC: HMLSF).

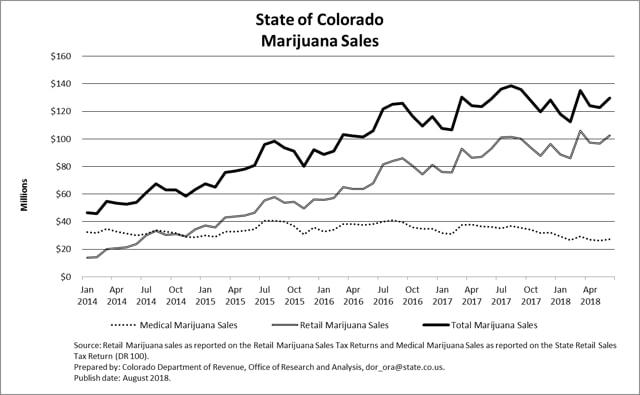

Colorado Sales Trends

One useful model for what national, legal cannabis sales can be found in Colorado. Colorado was the first state to legalize recreational cannabis with the first retail store opening in January 2014. As a result, Colorado has the most mature cannabis market which helps to illustrate how other US markets might look as they mature.

The Colorado government also published a great set of statistics on Colorado cannabis sales. The spreadsheet can be found here with monthly sales of both recreational and medical cannabis. This dataset includes only legal sales. The upward trend of cannabis sales is likely due to a combination of diminishing illegal sales and increasing cannabis use by Colorado residents.

To make this data a bit more useful nationally, I have combined this data with population data from the US Census Bureau to determine per capita usage trends1.

(The author based on data from US Census Bureau and Government of Colorado)

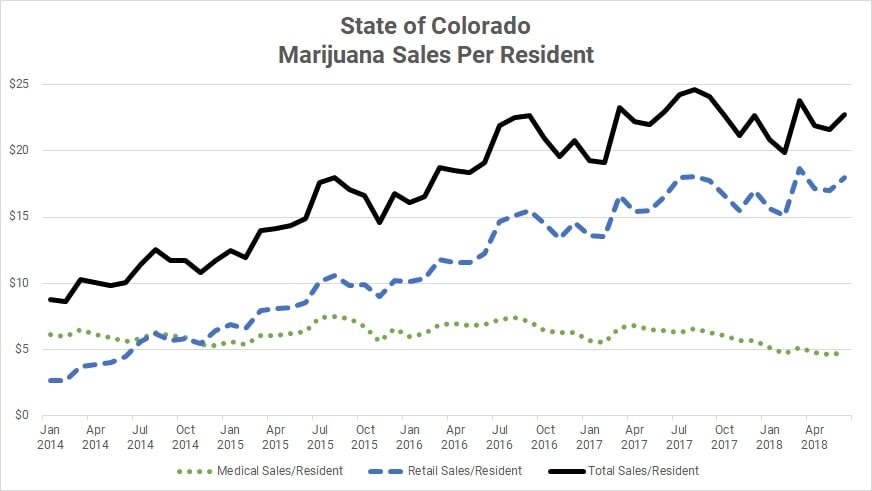

As illustrated, there is quite a bit of monthly variation in cannabis use. Recreational cannabis use varies ~40% more per month than medical cannabis use2. To smooth out this effect, it is more useful to look at trailing cannabis use per capita:

(Author based on data from US Census Bureau and Government of Colorado)

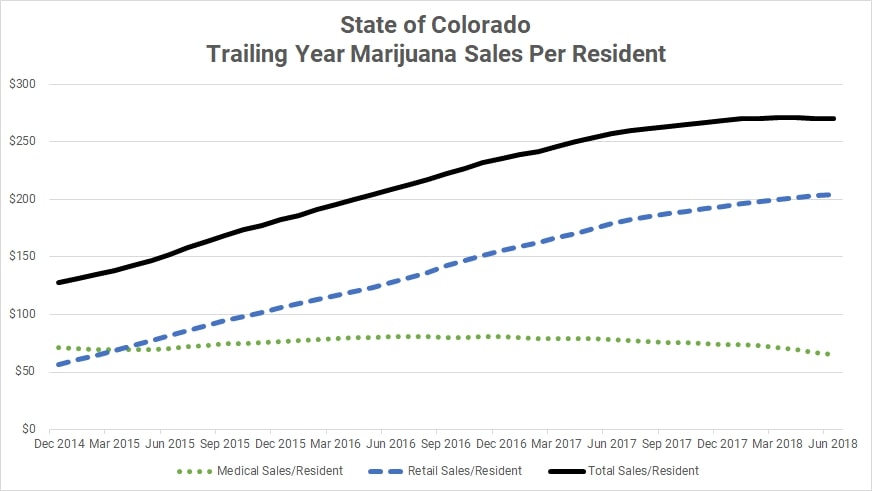

It may be a bit too early to tell, but it appears that demand has flattened out at around $270/resident per year. Since January 2018, trailing marijuana sales/resident have been within $1 of $270 after trailing y/y increases of 42% in January 2016, 28% in January 2017, and 13% in January 2018.

(Author based on data from US Census Bureau and Government of Colorado. Trailing figures and +/- is change since the period before it.)

Between January and June 2018, total sales have stalled at $270 per resident per years. Retail sales grew quickly in 2015, but that pace has slowed since then. So far this year, retail sales growth appears to be coming at the cost of medical sales - perhaps users are switching from medical marijuana to retail marijuana since the latter requires less work to obtain, or new users are just not signing up for medical marijuana since they can purchase retail marijuana.

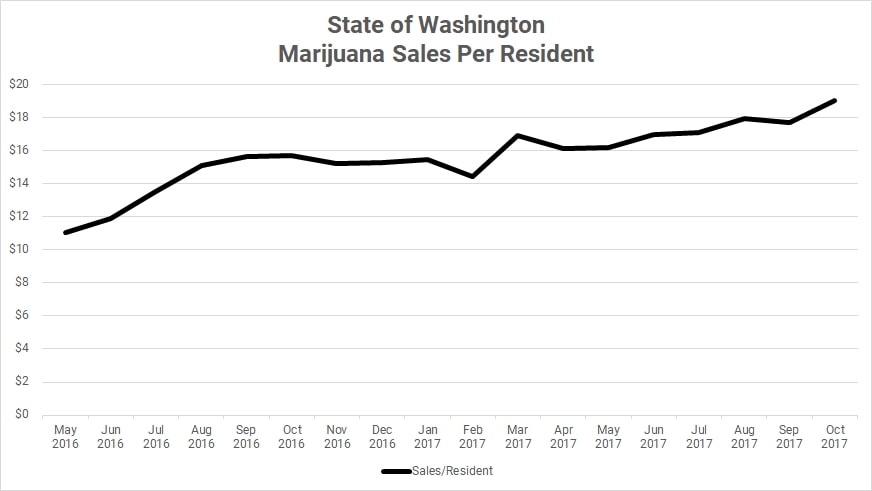

Washington State Sales Trend

Recreational cannabis stores first opened in Washington state in about July 2014, and so the market has also had time to mature compared to more recently-legalized states.

Washington state data is, as far as I can tell, only available up until October 2017. Washington state retail stores were slower to open than Colorado stores, and it took more time for the ramp-up to occur. As a result, Washington state sales are still growing rapidly3:

(Author based on data from US Census Bureau and Government of Washington)

In addition to this meager monthly data, Washington also provides annual sales data for their fiscal year, which runs from July 1 to June 30. As before, this data is incomplete, ending in October 2017:

(Author based on data from US Census Bureau and Government of Washington)

In FY2016, cannabis sales grew 198% per resident, followed by 72% growth in FY2017. Growth has slowed since then, with the first four months of FY2018 (up to October 2017) growing at a rate of 20% y/y.

Sales in Washington state are lower than in Colorado but are growing more quickly:

(Author based on same data as above)

It is too early to know for sure whether Washington's cannabis sales/capita will reach the levels of Colorado, but I suspect that they will be lower. When Colorado sales growth had slowed to the level of current Washington growth, annual revenue was much higher:

(Author based on same data as above)

When Colorado was at the same growth levels in Washington is today, annual sales were in the range of ~$250. Washington state annual sales are ~77% of the levels that Colorado was then, perhaps implying that Washington's eventual sales plateau will occur at ~$209 per resident per years.

Cannabis is also legal in several other states, including California, Oregon, Nevada, and others. Those markets are more recent than Colorado, however, and so, their market may not yet be "mature" - making it a tougher task to extrapolate what a mature cannabis market might look like in those states.

Extrapolating Nationally, in a Decade

Let's say, based on the above, that Colorado's cannabis sales are "mature" and are ~$270/person. Further, it's possible that a "mature" Washington state would sell ~$209/resident based on Colorado's past growth.

Extrapolating these figures nationally leaves a lot of room for error - see "Potential flaws in this estimate" below. Among other problems are selection bias (Colorado and Washington probably legalized first because their populations wanted to use cannabis more than other states) and the current lack of big money/marketing behind cannabis product development and sales (Constellation and Molson Coors (NYSE: TAP) are looking to change that). Those two factors push in opposite directions, and it is unclear which factor might predominate.

For the sake of brevity, let's say that those factors all cancel each other out and national use looks like "mature" use in Washington state. This would imply the current-day use of ~$209/person. Note that there's a huge amount of possible variability here as noted in "Potential flaws in this estimate" below. This estimate could easily be off by +/- 50% or more...

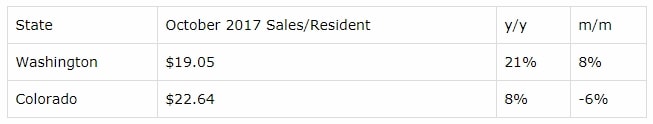

US 12-Month Trimmed Mean PCE Inflation Rate data by YCharts

In ten years (when cannabis may have been legal for years and markets had a chance to mature), our ~$209/person turns into ~$255/person based on an inflation rate of 2%/year.

Meanwhile, the population of the United States in ten years - in 2028 - might be ~355 million people (based on a US Census estimate from 2014 which might be a bit high since its July 1, 2018 population exceeds the current population).

With ~355 million people paying an average of ~$255/person for cannabis, the U.S. market for cannabis products could be ~$90.5 billion by 2028. There are a lot of possible flaws here, though, perhaps leading to a range of ~$45-136 billion/year. This is a very wide range, but it illustrates that massive size of potential legal cannabis sales and a reason why a subset of investors is excited to invest in legal cannabis companies.

Potential Flaws in this Estimate

There are several points which can disrupt the accuracy of a national estimate:

1. Mature market assumption: This methodology both assumes that Colorado is a mature market and assumes that the United States will be a mature market in 2028. Both assumptions could be incorrect. If Colorado is not yet mature, this would push a national use figure up. If, meanwhile, the United States is not a mature market in 2028, this would push a national use figure down.

2. Tourism can be a problem when extrapolating from existing data. For example, Nevada sold $37.9 million in cannabis in October 2017 with a population of ~3 million. However, it is probable that tourists are responsible for a not-insignificant proportion of these purchases. If cannabis were legalized nationally, tourists may be less likely to purchase cannabis while on vacation. This would push a national use figure down.

3. Distribution outside state lines: Cannabis from, e.g., Colorado or Washington state may be being transported, in large quantities, across state lines. People may cross into WA or CO, purchase cannabis legally there, and transport that cannabis further out or mail it. It is difficult to quantify how much of this might occur. Risks are somewhat mitigated by maximum sales laws in cannabis stores (you can only not buy more than ~1 oz, or ~$150-200 worth). Because of those laws, it is unlikely that this transportation is large-scale. However, individuals living near the border or legal states may cross state lines to purchase or individuals might mail cannabis to friends in illegal states. This would push a national use figure down.

4. Selection bias: The states that legalized cannabis first are likely to be stated in which cannabis is more widely supported and used. Thus, national use may be lower than in first-adopter states. Similarly, people might select states to live in based on cannabis legality. Some frequent users may selectively move to states with legal cannabis, whereas this would not occur if cannabis was legalized nationally. This would push a national use figure down.

5. Federal illegality: Cannabis is still illegal federal, even if that law is not enforced. Users in legal states may refrain from cannabis, or use less cannabis, due to this federal uncertainty. If cannabis were legalized nationally, use may increase even in CO and WA. This would push a national use figure up.

6. New products and marketing: When cannabis is legalized nationally, companies like Canopy Growth and others will spend billions of dollars developing the U.S. market. New products will be developed and marketed to consumers, increasing demand for cannabis even compared to demand in currently-legal states. For example, Molson Coors announced a joint venture with Hydropothecary (OTCPK: HYYDF) to develop a non-alcoholic cannabis beverage. These new products will be backed by millions or billions of dollars in collective marketing and will create demand that does not yet exist. This would push a national use figure up.

7. Price changes and taxation: We do not know how much cannabis will cost when it is legalized nationally. We do not know how it might be distributed or what taxes might be placed on cannabis. We also don't know just how far prices might be pushed down by commodification or how much branding and unique products might be able to keep prices (especially of products aside from simple dry cannabis) higher. This could push a national use figure in either direction.

8. New use patterns: Perhaps benefited by marketing, new use patterns for cannabis may emerge. For example, if cannabis-based drinks were offered at bars or sporting events and concerts, this could create increased demand for cannabis products generally. This would push a national use figure up.

9. Demographic and use changes: Ten years is a significant amount of time. In that time, ten years of people will have passed away (skewing elderly - the people least likely to use cannabis) and ten years of children will have matured into adults. Young people are currently the most likely to use cannabis, but again, there's no guarantee that this demographic trend continues - perhaps the next generation of post-millennials will be less likely to consume cannabis than millennials. I strongly suspect that this factor would push a national use figure up, but it could plausibly push in the other direction.

There are far more possible variations than just this, of course. In short, this is speculative.

Takeaways

When (or if) cannabis is legalized nationally in the United States, the market will be very large. I estimate that the market could amount to ~$90 billion in revenue in ten years, although that estimate is subject to a lot of factors that might increase or decrease that figure. This figure is also just the revenue from cannabis itself, and not revenue from by-product industries such as e.g., vaporizers for consuming cannabis.

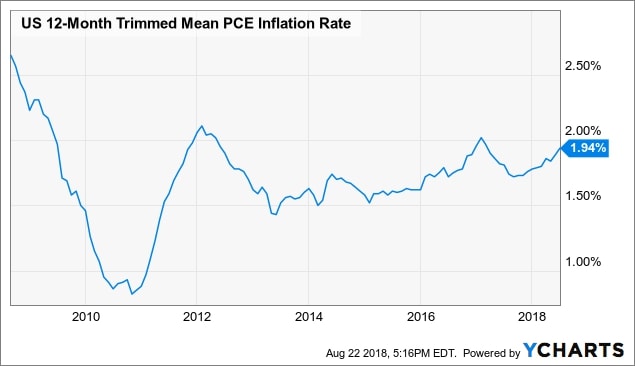

If cannabis might be $90 billion in revenue, how much could the market be worth?

PM PS Ratio (TTM) data by YCharts

In my view, the closest two comparable markets are tobacco and alcohol. Firms in those markets trade with a range of price/sales and enterprise value/revenue ratios, as shown above. Given the wide range of PS ratios (from ~1.4x to 5.3x), market caps for a potential American cannabis industry in ten years might total anywhere from $123 billion to $478 billion.

And that total includes only market caps due to sales in the United States - the actual companies operating in ten years (barring extremely heavy regulation) are likely to be international and generate revenue in other countries as well.

CGC Market Cap data by YCharts

Today, the cannabis industry is nowhere near that size. The most prominent American ETF for cannabis stocks is the ETFMG Alternative Harvest ETF. The market caps of its largest five holdings graphed above, have a combined market cap of ~$21 billion. Those five holdings account for over a third (~38%) of MJ's holdings.

Of course, this is not to suggest that those companies - or any that MJ holds - will capture the US cannabis market.

But perhaps this enormous market explains why Constellation was willing to invest $4 billion into Canopy Growth - a company with trailing revenue only C$78 million. There may not be much revenue yet, but the potential market is enormous - potentially larger than spirits, wine, or cigarettes:

(Market Insider)

But as usual, cannabis companies are a risky investment. Please invest cautiously and using proper diversification - while I hold shares in Canopy Growth and Hydropothecary, they make up only ~8% of my portfolio.

Best of luck!

Did you enjoy this article? Please consider giving me a "Follow" or "Like" this article. I also welcome all constructive feedback in the comments below. Thanks for reading!

Notes:

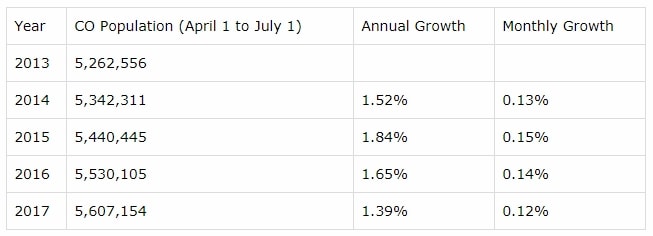

1. The US Census Bureau data is for the population between April 1 and July 1 of the given year (methodology of the Census Bureau). I have modeled the population to be steadily growing (as a percentage, not linearly) through the year and set the May population to be the given total. I have further modeled May 2017 to June 2018 (the end of the Colorado cannabis data) to continue at the same monthly percentage population increase (~0.12%/month) as was seen from 2016 to 2017:

(Based on US Census Bureau data)

This results in a June 2018 population of 5,691,836 Coloradans.

2. Based on the standard deviation of sequential m/m use changes. Medical cannabis m/m changes have a standard deviation of 7.3% while recreational cannabis m/m changes have a standard deviation of 10.3% (or 40.3% higher than medical use).

3. Using the same population data and methodology as for Colorado in Note 1.

4. The year-over-year growth used here refers to trailing four-month sales growth over the year-earlier trailing four-month sales growth. So, for example, the October 2017 figures for Washington state would be July 2017 to October 2017 sales divided by July 2016 to October 2016 sales. Monthly data is pretty limited, so we have to use what we can.

Disclosure: I am/we are long TSE: HMMJ, TSE: HEXO, CGC.

He wrote this article for himself, and it expresses his own opinions. He is not receiving compensation for it (other than from Seeking Alpha). He has no business relationship with any company whose stock is mentioned in this article.

Original Article on Seeking Alpha

About Cannabis Drinks Expo

Cannabis Drinks Expo is a must-attend event for those curiously eying the future of the burgeoning U.S. cannabis industry.

Cannabis Drinks Expo is a must-attend event for those curiously eying the future of the burgeoning U.S. cannabis industry.

We also cover the key issues surrounding the likelihood and timescale for legalization to other countries, as well as the impact of legalized cannabis on the traditional alcoholic and non-alcoholic drinks markets globally.

Who should Visit?

Cannabis Drinks Expo promises to be relevant for anyone involved in the development, production, distribution and retailing of cannabis and related products. It will also provide a vital networking opportunity for political analysts, medical experts and those involved in the development and implementation of legalized cannabis into new markets.

Attend Cannabis Drinks Expo in preferred city

Who should exhibit?

If you’re serious about the cannabis drinks category, we’re still keeping it as real as ever. At Cannabis Drinks Expo, our goal is to empower you with knowledge, network, and platform so you can grow and build your cannabis drinks business. CDE is where you will find cannabis brands and suppliers who are serious about building their business in this category exhibit.

Exhibit in preferred city

Potential exhibitors include (but not limited to): Medical marijuana producers, Cannabis growers, Cannabis producers/ product developers, Cannabis processors, Cannabis distributors/transporters, Wineries, Breweries, Distilleries, Branded drinks companies, Drinks manufacturers/producers, Pharma companies, Equipments and service providers, CBD manufacturers, Marijuana-Infused products and edibles providers, Testing and laboratory services, Logistics and supply chain operators, Drinks distributors/wholesalers, Drinks importers, Lobbyists/ public affairs businesses, Political advisors, and more.