News

Cannabis in the USA: Its Impact on Alcohol Sales, According to the Data

After marijuana been legalized in many states of the USA, the average sale of wine is decreased by 16.2%, while beer dropped 13.8% after marijuana legalized in the USA.

Legalised recreational cannabis is a new competitor for alcoholic beverages in the United States of America (USA). Nine states (mainly on the West Coast) and Washington DC have legalized cannabis for recreational use for adults over the age of 21, even though federal law still recognizes the drug as illegal. Medical cannabis is legal in a further 30 states and it has been decriminalized in another 13 states. To put this in context, 64 percent of the USA’s population now lives in a state where cannabis has been legalized.

According to the 2018 Annual Marijuana Business Factbook, in 2017, retail sales of recreational cannabis totalled almost US$3 billion and they are estimated to grow to between US$4 and US$5 billion in 2018. The report also estimates recreational cannabis sales will reach between US$12 and US$15 billion by 2022. In 2018, it is estimated that sales of recreational cannabis will overtake medical cannabis sales for the first time.

Transitioning from the black market to legalized sales

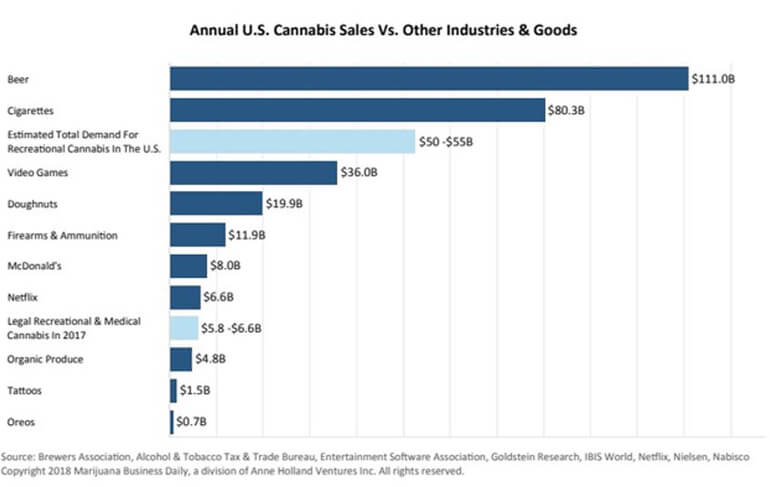

When compared with cigarettes and beer, sales of cannabis on an annual basis are quite small. However, it is estimated by Marijuana Business Daily that the total demand for recreational cannabis in the USA, including the black market, is around US$50 billion. If the USA Government legalized cannabis across the country, sales might start out around that level but they would possibly rise as cannabis gained greater mainstream acceptance. Eventually, cannabis could surpass cigarette sales – with the potential to rival beer (the biggest alcohol category) in the value of overall sales.

On 12 July 2018, the Wine & Spirits Wholesalers of America (WSWA) announced it was in favour of legalized cannabis in states that pledged to regulate the category like beverage alcohol. The trade organization (which represents the wholesale tier of the USA wine sector and provides members with representation before Congress and other regulatory bodies) has urged the federal government to respect a state's right to legalize cannabis and to create a path that leads to federal regulation similar to that of the alcohol industry.

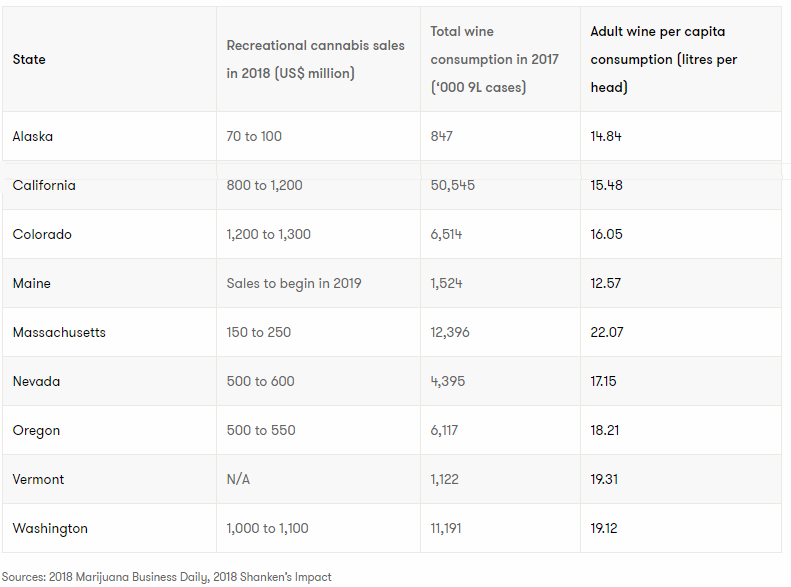

Of the nine states where the use of recreational cannabis is legal, those with the biggest wine consumption are California, Massachusetts, Washington, Colorado, and Oregon.

In Vermont and Washington DC, although the recreational use of cannabis is legal, neither allows cannabis to be sold or purchased.

Table 1: States where recreational cannabis is legal

Different consumption habits provide an opportunity for positioning

Currently, there are mixed positions regarding the effect of cannabis legalization on alcohol sales. Some studies evidence a decided drop in alcohol sales in states that have legalized cannabis, while others show no significant effect.

Recent research conducted through the TABS Analytics 2018 Wine and Liquor Study concluded that, as legalized, recreational cannabis becomes available in more states, it is not expected to have a significant impact on the purchasing of wine and liquor. This position is supported by the WSWA. ‘The data is not conclusive’, says Dawson Hobbs, acting executive vice president of external affairs for WSWA.

For wine, it is more likely to affect the low-priced end of the market rather than commercial or premium wine sales due to the occasion when cannabis is used – for relaxation rather than with meals. In California, cannabis is already popular, so one would assume that the impact on wine sales would be minimal. In Colorado, it is understood that cannabis is impacting on day-time drinking. However, wine is more often consumed in the evening, therefore, it appears that the potential impact on wine sales would be minimal there also.

Source: Wine Australia

About Cannabis Drinks Expo

Cannabis Drinks Expo is a must-attend event for those curiously eying the future of the burgeoning U.S. cannabis industry.

Cannabis Drinks Expo is a must-attend event for those curiously eying the future of the burgeoning U.S. cannabis industry.

We also cover the key issues surrounding the likelihood and timescale for legalization to other countries, as well as the impact of legalized cannabis on the traditional alcoholic and non-alcoholic drinks markets globally.

Who should Visit?

Cannabis Drinks Expo promises to be relevant for anyone involved in the development, production, distribution and retailing of cannabis and related products. It will also provide a vital networking opportunity for political analysts, medical experts and those involved in the development and implementation of legalized cannabis into new markets.

Attend Cannabis Drinks Expo in preferred city

Who should exhibit?

If you’re serious about the cannabis drinks category, we’re still keeping it as real as ever. At Cannabis Drinks Expo, our goal is to empower you with knowledge, network, and platform so you can grow and build your cannabis drinks business. CDE is where you will find cannabis brands and suppliers who are serious about building their business in this category exhibit.

Exhibit in preferred city

Potential exhibitors include (but not limited to): Medical marijuana producers, Cannabis growers, Cannabis producers/ product developers, Cannabis processors, Cannabis distributors/transporters, Wineries, Breweries, Distilleries, Branded drinks companies, Drinks manufacturers/producers, Pharma companies, Equipments and service providers, CBD manufacturers, Marijuana-Infused products and edibles providers, Testing and laboratory services, Logistics and supply chain operators, Drinks distributors/wholesalers, Drinks importers, Lobbyists/ public affairs businesses, Political advisors, and more.